As the world of investment compliance evolves and service demands grow, compliance professionals in the industry are frequently embracing technology and third-party providers to satisfy regulators' challenges and expectations. Collaboration with suppliers and service sources is essential for a successful and strong compliance program. The global Regulatory Affairs Outsourcing market was valued at US$ 6.6 billion in 2020 and is predicted to go beyond US $ 12.9 billion by 2030, growing at an 8.5% CAGR from 2021 to 2030, as per current reports.

Outsourcing of regulatory affairs tasks is being driven by a considerable increase in the fixed expenses of in-house resources for regulatory affairs and operation operations, including training, technology, specialist expertise, and facilities. However, compliance with current regulations has become a massive responsibility, let alone keeping up with global advancements.

Looking ahead to 2022, companies whose IT strategies enabled them to turn swiftly in the previous year will be better positioned to address new possibilities and challenges. Interestingly, they are introducing more flexibility this year.

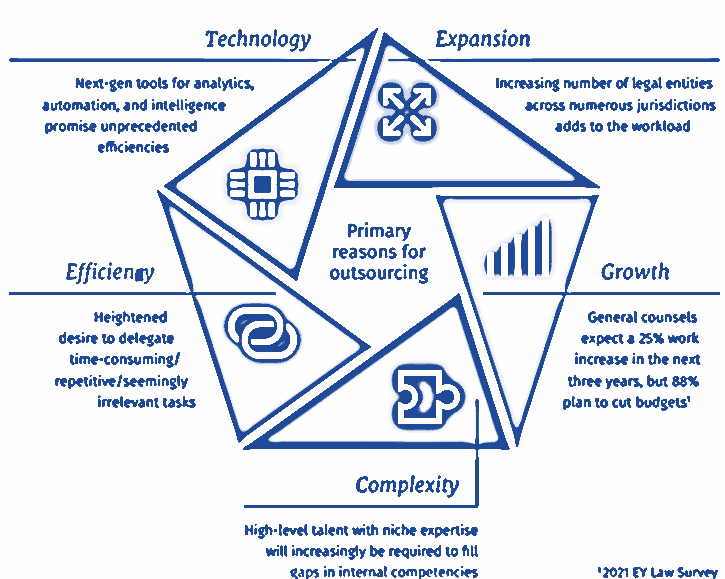

Outsourcing is no longer primarily driven by cost reductions. Corporate legal and compliance teams are overburdened with diverse tasks as well as ever-changing drivers. A combination of regulatory complexity, rising expectations, and increased demands on legal and compliance teams is causing extraordinary transformation in enterprises, affecting all aspects of legal and corporate compliance. The decision for major organizations is no longer whether or not to outsource services: 93% of legal departments currently rely on a network of legal and compliance service providers to conduct a wide variety of duties. In addition, businesses of all sizes are increasingly dependent on outsourcing, with the growth being most noticeable in businesses generating revenues ranging from $1 billion to $4 billion.

Following the initial shock of the pandemic, we observed what had been consistent, if not quite predicted, patterns in software development outsourcing undergoing something close to impact, with new procedures arising as businesses struggled to deal with the pandemic's effects on their operations. While some of those new advances are here to stay, some established procedures have made a strong comeback.

With technology driving digital change across many industries, the chronic tech skills shortage has no end in sight. The number of vacant software development positions in the US is predicted to be more than 900,000, with 1.2 million likely to be available within the next five years.

There is, however, a workaround due to the adoption of flexible work patterns in response to the epidemic, more firms are using distributed resourcing, including outsourced development teams. Using extensive global talent pools, IT directors may source software teams in weeks rather than months, for a fraction of the onshore cost.

Digital transformation is gaining ground faster than ever. According to a global analysis, the pandemic has accelerated the adoption of digital technology by the past two years. Digital transformation, as per eight out of ten CEOs, is essential for long-term survival. The ability to swiftly grow development teams with experienced engineers is essential, but most businesses aren't designed to be that nimble. There won't be many, if any, IT departments that can keep up with the newest technologies. Therefore, it should come as no surprise that 64% of IT executives feel their digital transformation projects require outside expertise. They're responsive to alternative talent sources including on-demand outsourcing.

As IT executives are challenged with survival problems such as business continuity, security risk, product volume, and employees’ modifications, on the other hand, many organizations put their innovation plans on hold and turned to outsourcing to save costs and optimize efficiency. Moreover, organizations are willing to restart their innovation strategies as the survival eases. Additionally, They are balancing the need to invest in innovative technology with the continuous usage of the operational efficiencies provided by outsourcing.

In any case, software development outsourcing will remain in high demand in order to achieve both innovation and efficiency improvements. In the long run, these advantages will lead to increased use of a larger range of outsourced applications.

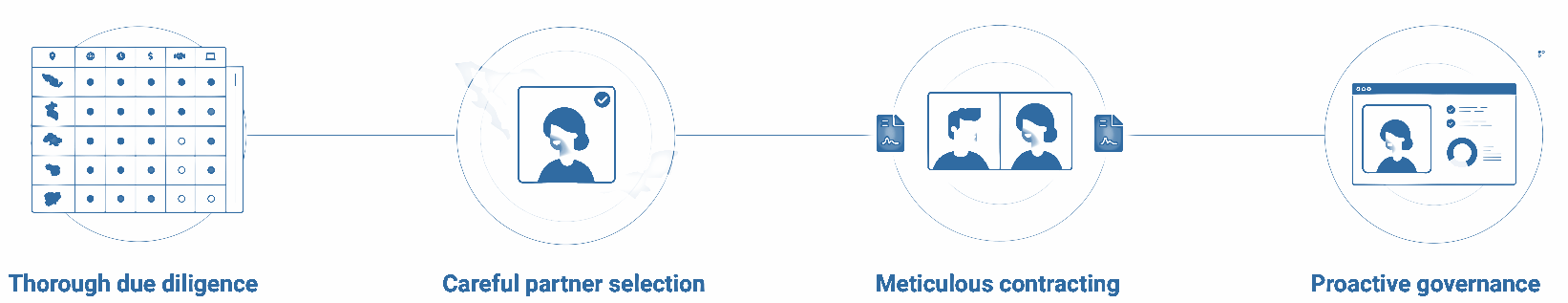

"Value networks" and "co-sourcing", buzzwords to distinguish the growing collaboration among businesses and their outsourcing partners. Complex controls are required throughout the outsourcing process for more complicated software development ventures with larger risks. Here are four critical areas:

In today's competitive environment, successful outsourcing entails building a strategic and inventive relationship rather than merely gaining access to cost-effective resources. Outsourcing firms and organizations alike must be prepared to scale up or down as needed, accelerate product development, make last-minute changes to pre-planned plans, respond quickly to new technologies, and upskill their staff, accordingly.