Instances of digital frauds and payment scams are extremely damaging for banks and money institutions. Not solely first-party fraud which incorporates a private or cluster of individuals that give false identity information to become a part of a legitimate system however additionally third-party fraud resembling information obtained from data breaches accustomed build online user accounts.

Digital transformation is reshaping industries, reworking groups, and operational prototypes at a pace in no way earlier than seen. This wave of alternate is an increasing number of putting customers at the center of virtual innovation – for that reason, it’s critical that stable identification verification is carried out as a part of online source providers’ operations.

Identity is the characteristic of identical, the correspondence of one factor with some other while compared. It is the set of precise trends and traits related to a completely unique and irreplaceable individual. Identity verification is a critical requirement in maximum tactics and approaches, each online and offline, in all styles of situations, from establishing a financial institution account to finishing tax approaches electronically. In banking as well as industries, the identification verification manner is known as the KYC (Know Your Customer) manner.

It is vital to recognize that specific varieties of identification verification strategies had been evolved for the online channel. However, now no longer they meet the vital attributes for the method to be done adequately and reliably.

In the digital environment, the probabilities of criminal acts and fraudulent tries are increasing. Following are the areas where ID verification practices can be applied to prevent criminal activities:

The maximum number of frauds are prevented through the mechanism - ID verification. Banks and financial organizations are underneath the regulatory responsibilities of verifying every onboarding identification to minimize the excessive capacity financial crimes simultaneously with money laundering and investment of terrorist activities.

Amongst all chargeback frauds, 86% are of friendly fraud growing at a price of 41%. All calculated digital frauds cost online stores a mean of 1.47% in their usual revenue. In chargeback fraud, an individual asks his banks or credit card company to request a chargeback over a few products which he has now no longer ordered. The online service provider could switch the cash without even suspecting the fraud. Lastly, the fraudster who made the purchase receives cash as well.

The digital payment services are underneath the threat of suspicious transactions. Unauthorized approach over user accounts is often to blame for transferring funds to some suspicious destination. Money laundering and illegal funds transfer actions are achieved through digital networks.

Currently, mobile fraud is the leading fraud where fraudsters are capable of get admission to the personal statistics and impersonate as though a valid user is creating a request. ID verification for clients enables mitigate the dangers of fraud that arise through cellular devices.

There exist some frequent mobile frauds that are escalating promptly with the access of the Internet as well as mobile devices. With fluctuating but nearly similar amount calculations, these mobile frauds are turn out to be part of daily mobile users. However, the requirement is to reduce the crimes by certifying a rigorous ID verification.

Digital ID verification is the individual solution that aligns properly as consistent with the regulatory necessities of safeguarding KYC compliance. Also, to prevent again in opposition to the high-scale financial crimes along with digital frauds, virtual identification verification is the most admired solution through organization entities.

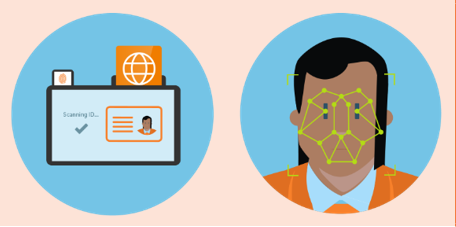

ID verification includes diverse strategies of verifying the identification of clients where document verification is the only one implemented by businesses. In digital document verification, a user's government-issued ID card is scanned to make sure that it has now no longer been digitally manipulated or concerned in suspicious activity. ID verification presents a durable responsibility as authentic for online businesses. It is critical to guarantee that the net user who's maintaining the ID is definitely the only who they are saying they are.