Given the rise in regulatory standards and technological advancements - banks, financial institutions, and other new institutions are always striving to achieve these standards and protect themselves from financial crime while keeping operating costs low and increasing their service. Besides this, new financial rules impose a dynamic regulatory compliance check, which is challenging for big institutions to oversee, globally. The pandemic and the risk of a recession have worsened financial institutions' concerns, affecting agent availability, operating costs, and transaction volumes.

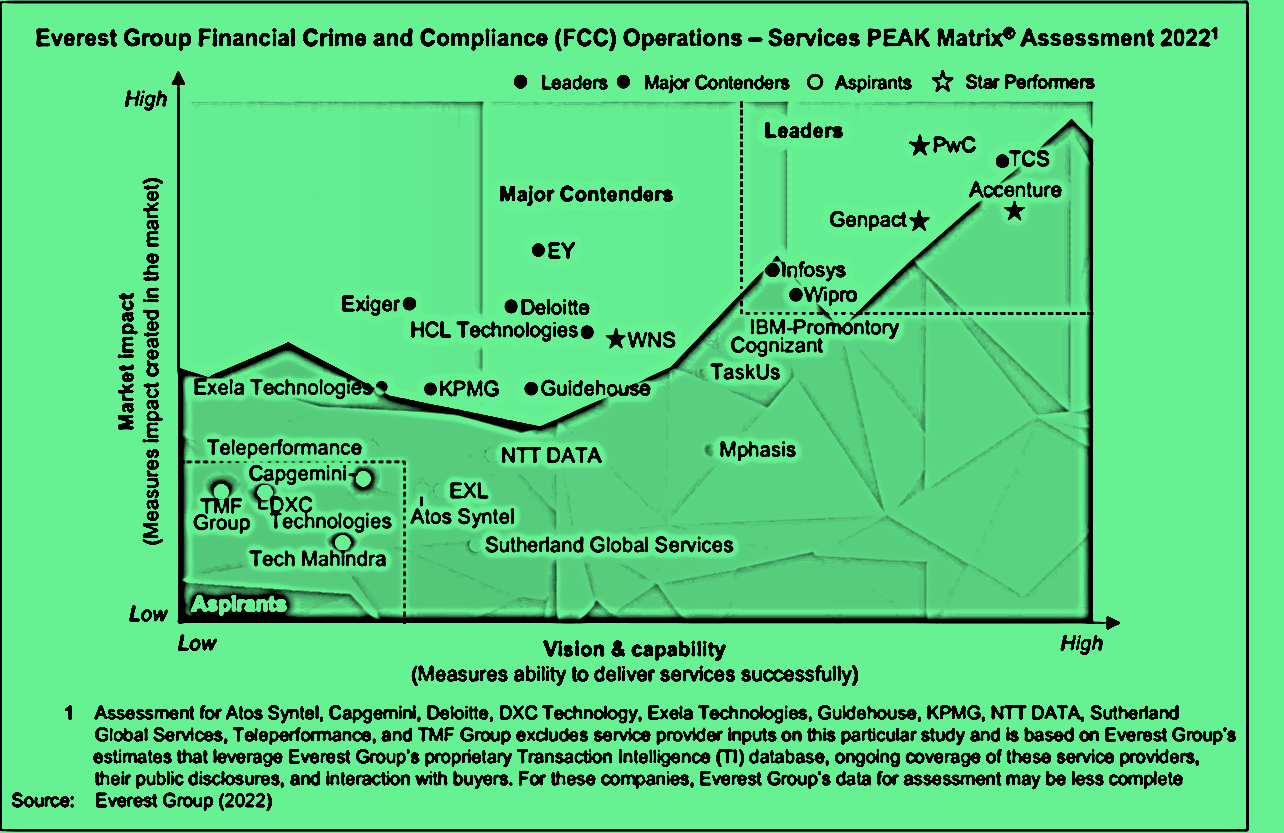

The increased demand for Financial Crime and Compliance (FCC) assistance and digital solutions has created possibilities for service providers to expand their skills and add advice, platform-led services, as well as advanced digital solutions to their offerings. Interestingly, consumers continue to prioritize increasing efficiency and productivity by eliminating false positives and manual intervention, as well as limiting profile risks. However, service providers may now go beyond managing operations and convert interactions into strategic partnerships.

RegTech - more than a buzzword and a very realistic effort that is already influencing regulatory compliance. The rise in financial crime has alarmed global regulatory watchdogs, creating RegTech. Businesses in the digital era are efficiently complying with the altering regulatory landscape by adopting innovative technology. Regtech not only reduces the cost of compliance processes, but also enhances their quality, making procedures more robust and reducing friction and the risk of compliance failure.

With increased demand for digital financial services and an increase in criminal activities, new opportunities for the RegTech industry are emerging. Furthermore, big data, cloud computing, and machine learning algorithms, in general, can be used by the industry to help heavily regulated businesses and regulatory bodies by implementing a collection of automated risk management methods, regulatory reporting solutions, and an internal compliance policy process.

A brace of recent evaluations on the global RegTech market expect excellent growth for the sector, however, analysts disagree on their forecasts. As per Custom Market Insights, RegTech revenues were estimated at $6.8 billion in 2021, with forecasts of $8.1 billion for the current year, rising to around $44 billion by 2030, globally. On the contrary, according to a new IMARC Group report, RegTech Market: Global Industry Trends, Share, Size, Growth, Opportunity, and Forecast 2022-2027, estimated the sector to be worth $8.7 billion in 2021.

Recently, RegTech has gained traction as it reduces compliance failure risks, enhances efficiency, minimizes costs and speeds up the overall business processes. In addition, product demand has increased due to the integration of artificial intelligence (AI) and the Internet of Things (IoT) with linked devices to automate fraud prevention, employee surveillance, and compliance data management.

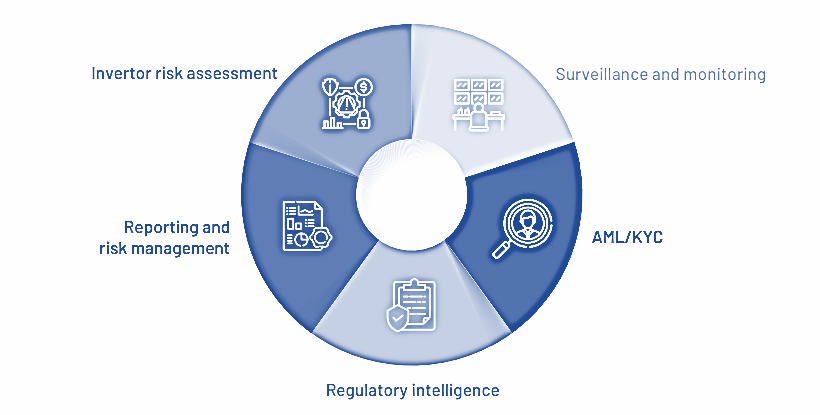

For organizations, considering bracing themselves and manage the risky areas of AML regulations, fraud and sanction risks, following trends must be followed:

RegTech has the potential to have far-reaching consequences with continued government funding and business investment in research and development. The size of data continues to rise, as does the financial industry's capacity to control it.

Additionally, many organizations are significantly investing in data optimization in order to meet regulatory responsibilities, as well as embracing new technologies in order to extract value from their data. RegTech has huge potential to assist organisations in cost control and compliance reform. Therefore, the significance of data management and collaboration among stakeholders may make data collecting and analysis easier and more efficient. Moreover, it has the potential to help overcome service gaps and improve service quality.

Currently, the payment system landscape has been drastically altered by digitalization. Domestic payment systems have been more inclusive, secure, and efficient since the emergence of fintech and blockchain technologies. Despite the transformation, cross-border payments remain costly, delayed, and opaque, with multidimensional constraints and complications. Every cross-border payment must comply with a mass of technological, regulatory, and legal systems, raising transaction costs, diminishing efficiency, and jeopardising market integrity and financial stability.

Countries/regions are captivating a variety of bilateral and multilateral approaches to improve cross-border payments systems, including achieving economic and monetary integration (with or without a joint central bank and settlement system), improving interoperability through the use of uniform messaging standards, utilising advanced technologies such as distributed ledger technology (DLT) or centralized fast payment systems (FPS) in providing remittance services.

As the anti-money laundering (AML) and KYC compliance are becoming progressively more critical this year, many organizations are investing broadly in their own KYC compliance processes.

Despite the fact that both fintech’s and regulators have shown a readiness to move toward uniform KYC criteria and standardize internal procedures, there is still more work to be done. A variety of global and local efforts aiming at enhancing the process on a global scale have come and gone. Working through these problems requires businesses to be proactive and collaborative in order to effect significant change.

A new wave of KYC and AML-focused laws has begun to guide online companies, in particular, into safer standardization, globally. Many organizations are changing away from a reactive approach to KYC and toward a more proactive regulatory strategy. Meanwhile, technology is essential for a successful approach to KYC compliance. When it comes to automating compliance procedures, digital identity verification, intelligent data protection, centralized document repositories, and registries are becoming recognized technological solutions. Furthermore, reducing the usage of error-prone manual techniques will allow teams to be more proactive in combating financial crime by using an efficient KYC solution. Not only does integrating KYC solutions reduce errors, but it also reduces friction during onboarding, resulting in a better overall user experience.