FATF Regulations are set to tackle Decentralized Finance (DeFi), the Wild West of Crypto - GetFledge

The blockchain-based DeFi system is a new alternative finance system. The DeFi platform enables users to engage in traditional financial transactions that are settled on a public blockchain

In brief

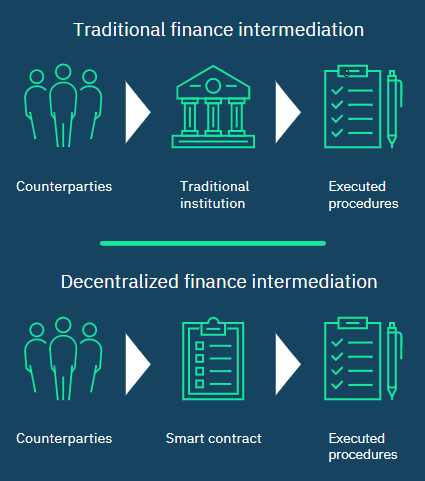

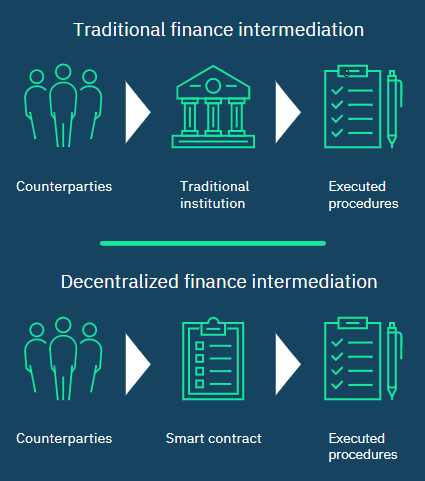

- Decentralized finance ("DeFi") encompasses the various applications of blockchains and cryptocurrencies intended to transform the current centralized global financial infrastructure through the introduction of a new internet-based decentralized model for performing financial transactions with less reliance on centralized financial intermediaries.

- With DeFi's substantial growth, traditional financial institutions are likely to have a variety of growth opportunities, while they may also be threatened by the existing financial services they provide.

- As the global financial system evolves, the role that financial institutions play will be impacted by how they respond to this new form of decentralized autonomous financial intermediation.

- Even though DeFi is still in its infancy, there is still the opportunity for market leaders to shape the ecosystem and help shape the market. A centralized and traditional finance firm should decide where their best positions are for participation and contributing to proactive responses to the risks that this market innovation poses to their model.

The DeFi Evolution

More Oversight Regulations For DeFi Firms

Global watchdog says cryptocurrency companies providing stablecoins, blockchain-based decentralized payment apps, and peer-to-peer services may need to keep track of users' identities and money to prevent money laundering and terrorism financing.

The Financial Action Task Force (FATF), a global agency that combats money laundering, has issued its updated guidance for firms that handle cryptocurrencies and virtual assets. The regulatory framework may be designed to connect much of the nascent industry to the existing banking framework.

Based on the FATF's updates to its 2019 guidelines and its follow-up report from 2020, a new set of guidelines has been issued. They impose new rules on everything in the $2.5 trillion cryptocurrency market, from crypto exchanges to custodians, challenging an industry that says it doesn't have to adhere to many of the existing financial regulations.

With the new regulations for virtual asset service providers (VASPs), which incorporate industry feedback from April 2021, regulation of crypto firms is inevitably taking place, both centralized and decentralized.

FATF has been trying relatively recently to integrate new areas like decentralized finance (DeFi), non-fungible tokens (NFTs), and decentralized autonomous organizations (DAOs) into its framework. "Unhosted wallets" (also known as non-custodial wallets among crypto users) have been included by FATF as part of their attempt to account for crypto transactions.

Due to the fast-moving nature of DeFi, it has proven to be challenging to provide guidance in this area, given that the FATF standards are generally applied to financial intermediaries. According to FATF, AML regulations should apply to individuals who maintain a degree of "control or sufficient influence" over a DeFi arrangement.

DeFi developers in those circumstances where they are able to restrict coin listing on a decentralized exchange, control an online domain that allows users to access the platform, or otherwise have the ability to interfere with the activities of a DeFi marketplace in a significant way may very well be regulated.

Over the past year, DeFi has gained huge traction. However, it is unclear how exactly it will develop over time, and at what point will it be incorporated into traditional finance, as well as whether or not protocols will become decentralized or partially decentralized?

DeFi adoption

Highlights from FATF Guidance

The FATF's recent guidelines include highlights on stablecoins, peer-to-peer transactions, and DeFi ecosystems. They are:

- Those supplying stablecoins, as well as exchanges and custodians who support them, will have to comply with all applicable rules and undergo comprehensive anti-money-laundering and anti-terrorist-financing checks. The FATF advised countries to mitigate risks even before they launch a stablecoin, and to monitor their efforts thereafter.

- According to the FATF, countries can impose additional requirements, such as maintaining additional records or limiting transactions to designated addresses. Since this sector is growing rapidly, there are likely to be changed in the level and nature of risk that needs to be addressed, stated the guidelines.

- According to the guidelines, DeFi creators, owners, and operators may be required to comply with the FATF's regulations. According to the guidelines, it seems quite common for DeFi arrangements to describe themselves as decentralized when a person with sufficient control or influence is actually involved, and jurisdictions should apply the VASP definition regardless of self-description. A development team behind a DeFi app that allows people to trade, lend, and borrow without intermediaries would be responsible for anti-money laundering checks even if they sold or distributed governance tokens to investors and users, the guidelines stated. Countries can request that a regulated entity be involved in the app's activities if there is no central party responsible for the service.

How can Fledge help

We have provided traditional financial service organizations, Blockchain companies, Money Service Businesses (MSB), FinTech & RegTech, Saas & Technology firms, and many more with our Audit & Regulatory Compliance Services. These services include:

- Using a risk-based approach, design and execute the implementation of enterprise-wide AML, sanctions, and CTF policies, procedures, and strategic processes and controls

- Maintain relevant procedures, processes, and systems in light of changing products, risks, threats and/or regulatory landscapes

- Assess complex issues and structure potential solutions which drive effective resolution within permissible regulatory frameworks

- Identify and address potential risks; stay abreast of developments in applicable legislation and guidance (domestic and international where applicable to current or potential business activities)

- Adjust, maintain and the run the AML/CFT monitoring & reporting of the organization

- Retrieve, consolidate, and report AML/Compliance KPIs to support the Board in making an informed decision

- Promote and develop the culture of compliance within the organization

- Participate in the product development from early stages to ensure compliance prior launch

- Compliance to data protection & privacy controls and framework under GDPR and CCPA