The Sarbanes-Oxley (SOX) Act is commonly associated with protecting buyers from illegal financial exposure with accounting, finance and control procedures. As inventions have become more and more prevalent today, the risks of financial exposure presented by cybersecurity threats have become more prominent than ever before. According to the progressive FBI Internet Crime Report for 2020, $4.2B in deficits had been stated in 2020 (up from $1.4B in 2017). The recent report, Gartner Hot Spots records cyber susceptibilities as one of the maximum crucial threat areas for auditors to deliver.

It is important that regulators uphold protections against those trends and the potentially adverse effects they could have on investors. Auditor must recognize the pressing needs at a critical intensity to play a constructive role in the success of their organization.

This is basically a regulation requiring that corporations make available appropriate financial statements and have internal regulations to safeguard financial information with the general goal of reducing negligence and misconduct that threaten consumers and the public.

Regulatory requirements will simply continue to grow within the area of cybersecurity, a fact that will be apparent to average organizations. Organizations that are looking ahead will realize that the area of exhibiting compliance and threat control actions publicly is no different from any other place in which they compete. A company that sees SOX and similar packages as an opportunity to demonstrate its ability to adapt to new requirements and put their traders at ease with its risk management approach could be the most advantageous investment.

In order to comply with SOX cybersecurity requirements, four steps need to be taken:

Generally, the level of complexity and extensiveness of this step will largely depend upon how big the organization is and what risks they may be facing. Regardless of the size of the organization, the best approach to apprehend the cybersecurity threats relevant to SOX is to start with the assistance of performing a risk assessment. Including those new considerations in your current SOX chance evaluation process is a good option. If this is the case, it may be necessary to ask additional questions beyond the ordinary method of wondering about money and finding out about corporal punishment. This method of interrogation entails information from all phases of the audit team, including input from the steering committee and board, in order to determine which potential cybersecurity risks your organization will choose to investigate.

An important component of quality practice is a consistent framework that is used as a basis for the manipulation of the environment. Several organizations use the NIST Cybersecurity Framework (NIST CSF) as a baseline for designing Cyber SOX controls on a regular basis. As part of the execution, controllers will be taught with the aim of communicating why certain controls are in place and communicating the failure or intention to be regulated completely based on a changing environment.

Additionally to internal controls, the Cyber SOX regulations must be disclosed. In summary, periodic self-evaluation, confirmations, and various self-endorsements are the necessary elements to achieve this. An audit team provides a valuable resource for verifying the effectiveness of the control program. In the event that a breach occurs, an audit organization that has an understanding of this trend can provide realistic and actionable strategies to enhance resiliency. A critical discussion on these matters and an evaluation of documents can offer valuable insights into the maturity level of the SOX cyber disclosure rules as well as the program in general.

As Sarbanes-Oxley compliance has grown in importance, and as the COVID-19 pandemic continues to spread, companies are striving to use technology to empower them. Recent research surveyed greater than 650 audit, compliance, and finance leaders during the first quarter of this year indicate that 65% have expanded SOX compliance hours by more than 10% over the previous year. Costs associated with internal SOX compliance have also been on the rise, but the outcome was mixed. Some organizations have seen SOX compliance costs rise in recent years while others have seen them decrease.

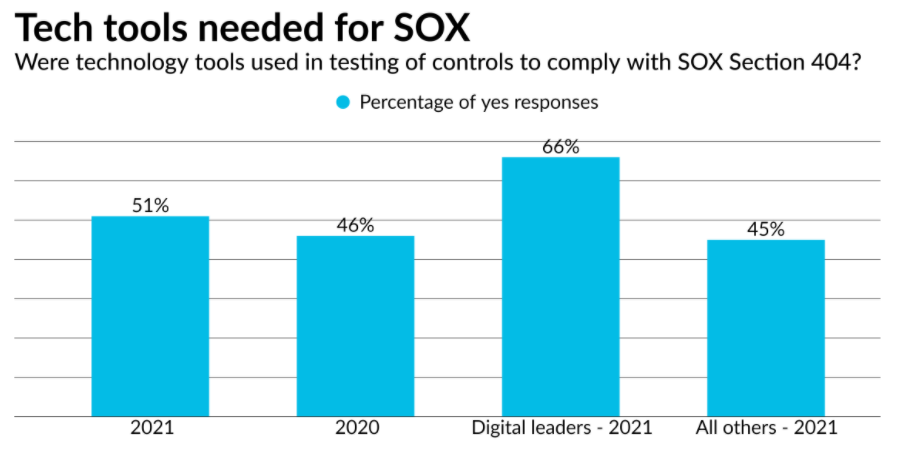

The survey reported that 56% of those who participated in the virtual leaders' survey had changed their ways of using technology over the past year, compared with 41% of all other respondents. Compared to 46% in 2020, 51% of respondents in the 2021 survey said "yes" to the question of using testing controls to conform to Section 404 of SOX, which mandates audits of internal controls. In comparison to the 45% for all other organizations, 66% of those visible as virtual leaders selected "yes".

When considering the benefits of complying with SOX and the dangers posed by non-compliance, it's important to think about this area. To ensure that everything goes smoothly and that your initiative remains compliant, it is always useful to seek professional assistance.

We at The GetFledge possess the skills and knowledge necessary to help you gain compliance with SOX and are trained to fulfill this particular task.